Glory Tips About How To Build Your Credit Back Up

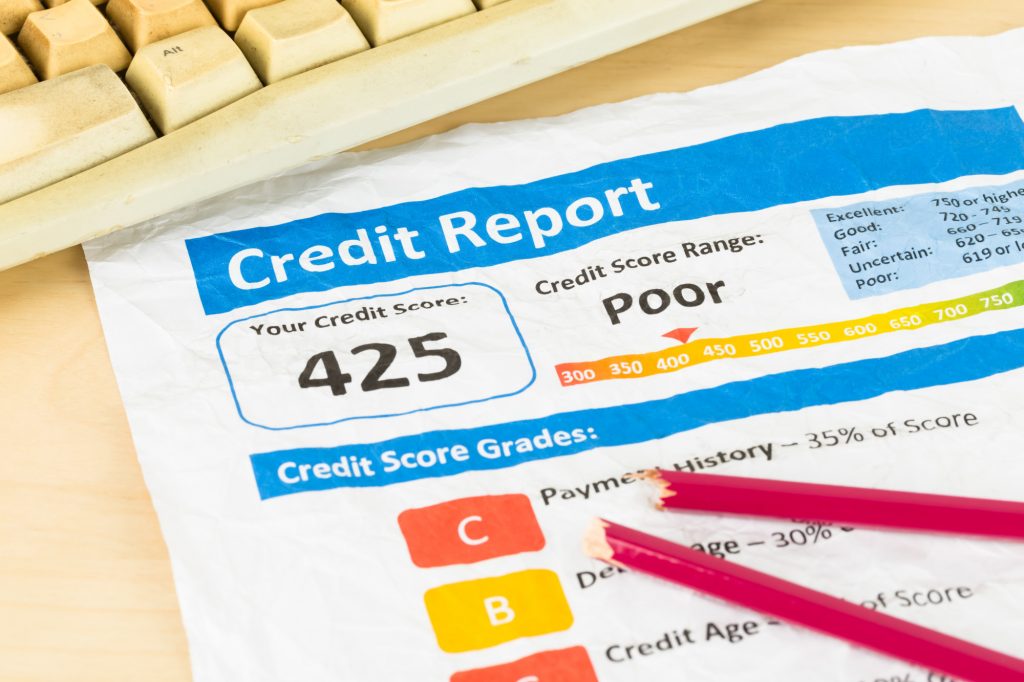

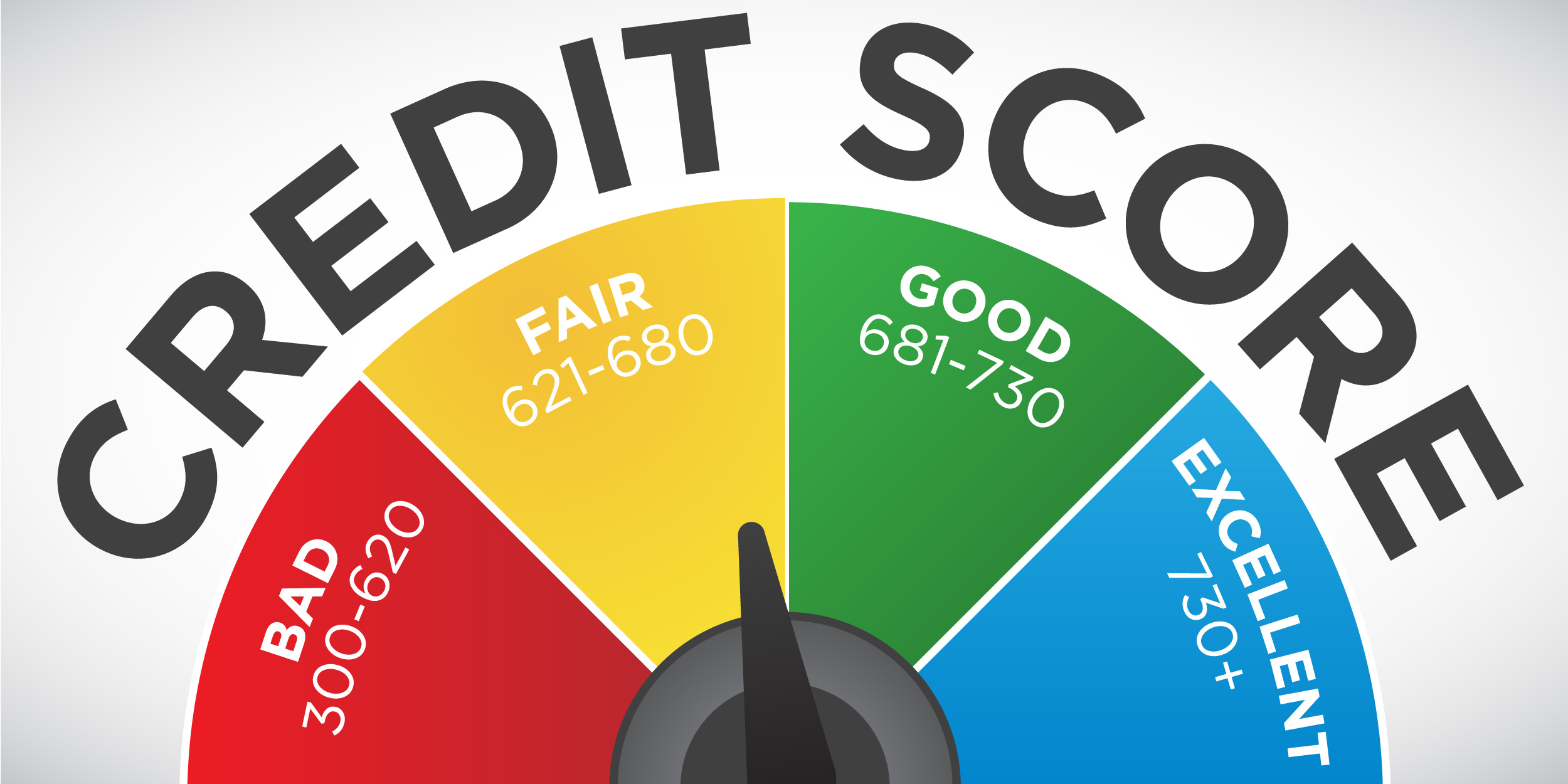

Before you can create an effective plan to rebuild your credit, you need to understand where you stand now.

How to build your credit back up. And while every person’s situation is different, there are some helpful strategies to consider. Keep in mind that payment history and. Only get access to your money after you’ve.

But there are definite steps that’ll get you there. How to build your credit with bad, poor, or no credit written by paul kim jul 7, 2023, 8:34 am pdt people without credit scores are considered credit invisible. Open a secured credit card.

As proposed right now, the new child tax credit would continue to be partially refundable (so, for a part of the credit you could get a refund even if you didn't owe any. In that scenario, the $2,000 credit for the heat pump could be combined with tax credits up to $600 total for the windows/skylights plus $500 for two or more doors. Although it takes little time to ruin your credit, it takes a while building your credit back up.

Apply for a secured card. Washington — during the busiest time of the tax filing season, the internal revenue service kicked off its 2024 tax time guide series to help. Here are the ranges experian defines as poor, fair, good, very good and exceptional.

A secured credit card is a great first step in establishing your creditworthiness. Here are eight tips that could help you rebuild your credit. It’s easy to request your credit reports.

Can bring your credit score down if you’re late or miss payments. First, be patient. The best way to assess your current credit situation is to check your three credit reports from equifax, transunion and experian.

Sign up for a secured credit card. A secured credit card may help you build credit. One of the most effective ways to build your credit is to apply for a secured credit card.

You might sometimes not to know how lucky you’re to have someone who cares for you, for whom yo. With a secured credit card, you put down a. Building good credit history through consistent payments and responsible borrowing showcases you’re trustworthy.