Nice Tips About How To Write The Irs

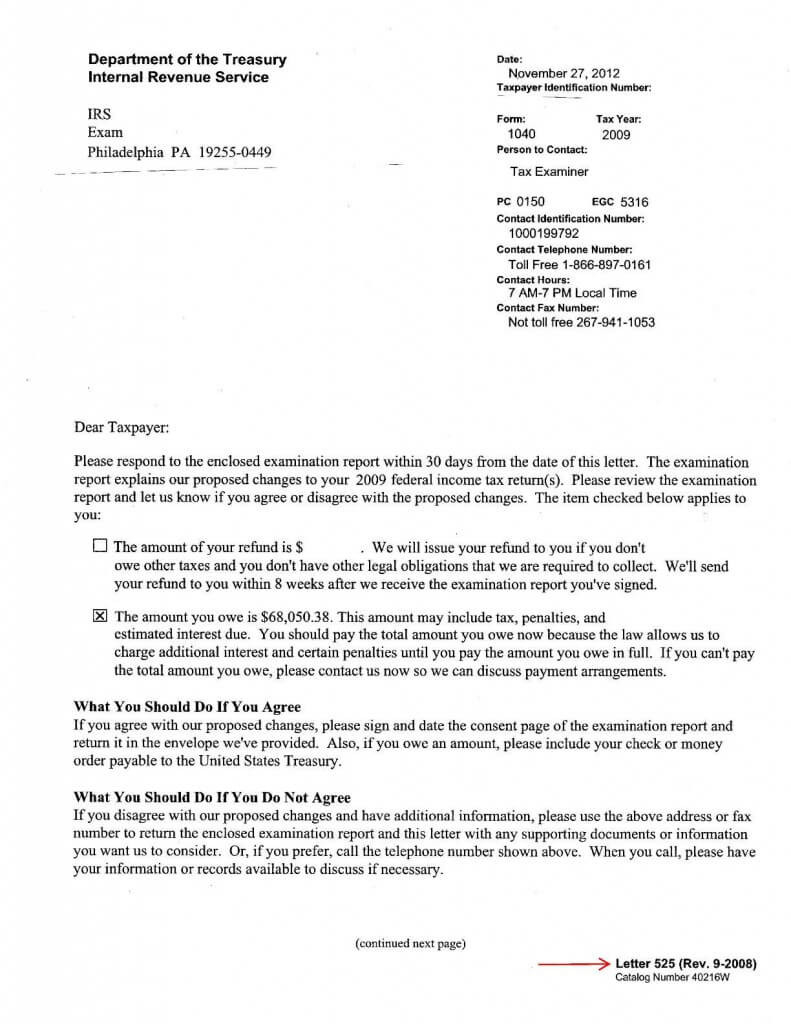

Do respond timely.

How to write to the irs. Whether you are disputing a tax assessment, challenging a penalty, or disagreeing with the outcome of an audit, it is crucial to effectively communicate your. Irs.gov has resources for understanding your notice or letter. The wait time to speak with a representative may be long.

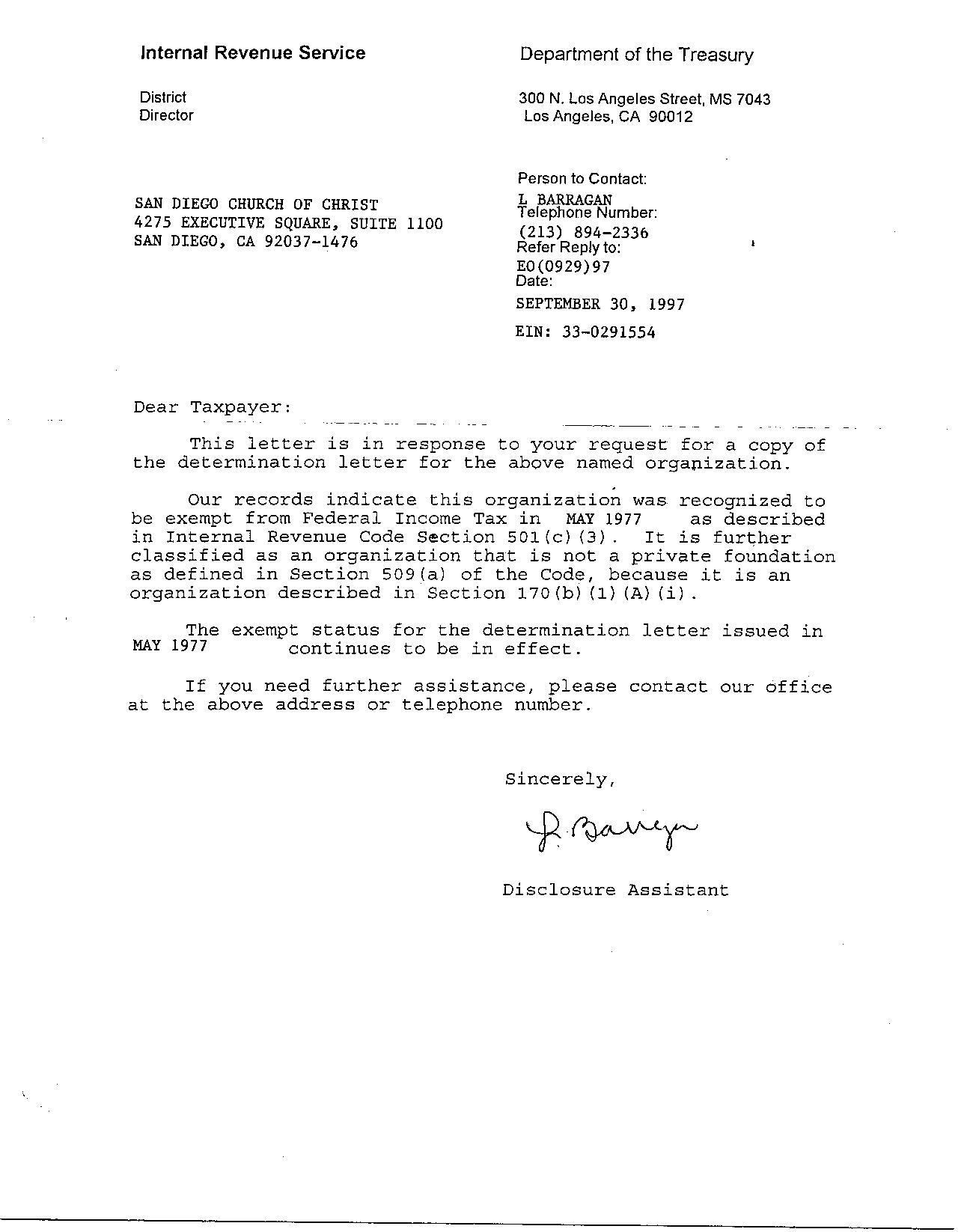

How to write an explanation letter to the irs? Visit an irs taxpayer assistance center. According to the irs, your letter should include the following:

If you meet those requirements, you may be able to file directly with the irs if you lived and earned your income exclusively in massachusetts for all of 2023; Opening paragraph body of the letter specific tax issue supporting documents closing paragraph signature enclosures copy of letter and documentation. If the notice or letter requires a response by a specific date, taxpayers should reply in a timely manner to:

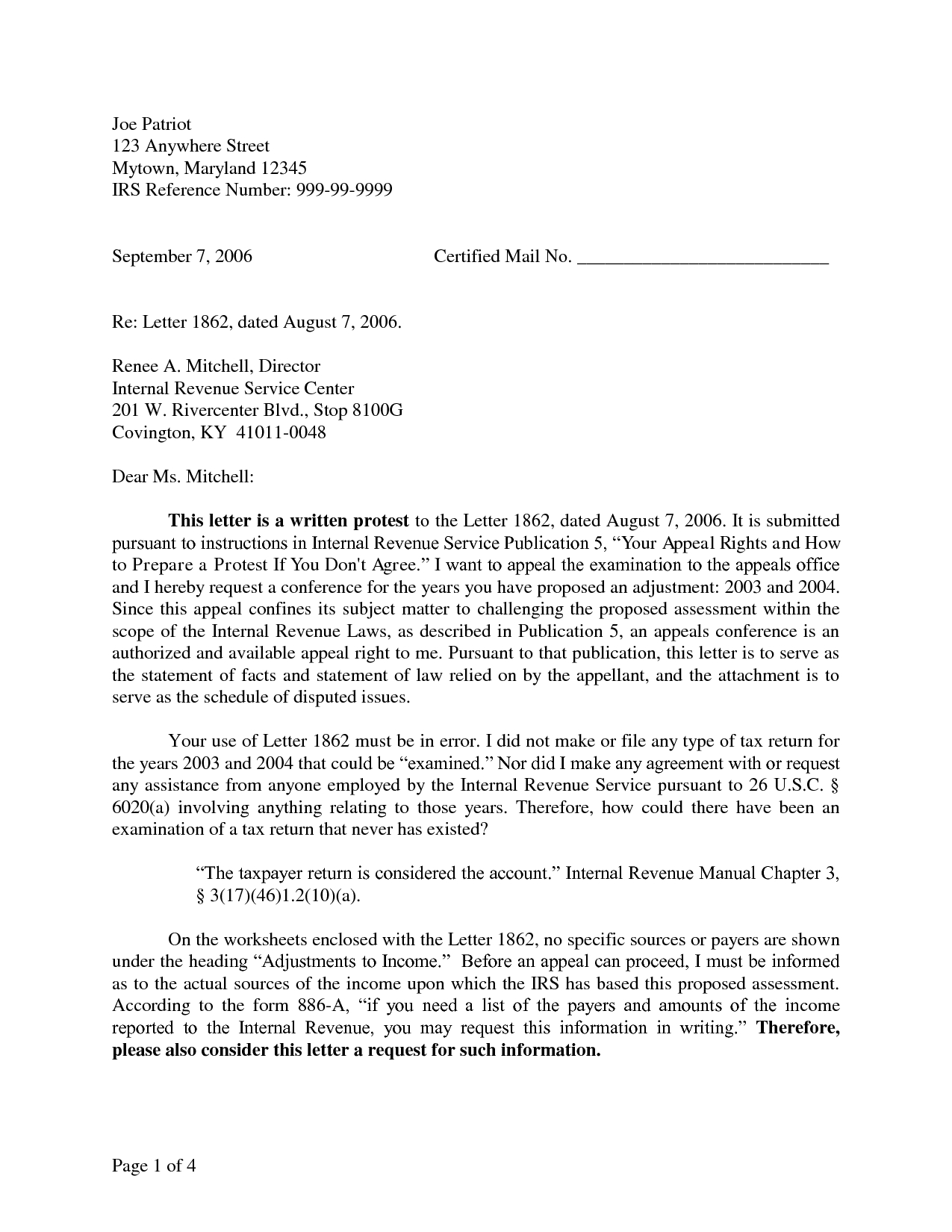

This isn't a letter to inform. Use form 12203, request for appeals review pdf , the form referenced in the letter you received to file your appeal or prepare a brief written statement. Fill in the payee information step 4:

There are tools for setting up a tax payment plan, requesting. Write the check amount in numbers step 5:. In fact, taxpayers should confirm everything they.

However, if you’re not able to resolve a tax issue, it may be helpful to. If your irs problem is causing you. Letter 6419 your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue.

If your adjusted gross income is $79,000 or less, you can file electronically with irs free file. Browse common tax issues and situations at get help. Depending on your requirement, there are different samples for you to look at and write a letter of.

Taxpayer’s name, address, and contact information a statement expressing your desire to appeal. How should you format a letter to the irs? Write the date on the check step 3:

While many tax forms must be sent by jan. Reach out online or by phone the irs has online tools for many of common taxpayer requests.

The main thing you need to do is clearly explain why you are. Find out what information you need, what. The irs is sending out what it calls an lt38 notice to let you know that during the pandemic some collection notices were suspended.